With an unparalleled focus on payments, Marc Milewski boasts a remarkable 15-year journey in the realms of both banking and fintech. His illustrious career began at VersaPay, where he played a pivotal role in shaping Canada’s first EFT gateway. Over seven years, Marc spearheaded countless rollouts across diverse business landscapes, gaining a profound understanding of market gaps.

In 2017, driven by an entrepreneurial spirit and a vision of Payments as “financial interactions,” Marc ventured out to the Maritimes, leaving VersaPay to establish his payment company. During his consultancy days, fate brought him together with Miles Schwartz, Zūm Rails’ co-founder and a maestro in Data Aggregation.

Reflecting on those early days, Marc Milewski shares, “I was working as a consultant and ISO to generate revenue streams to fund version one. It was here that I met the other co-founder of Zūm Rails, Miles Schwartz while consulting.” United by Miles’s expertise and Marc’s Payments insights, Zūm Rails emerged in 2019, evolving from two individuals at a kitchen table to a robust team of 30+, offering groundbreaking payment solutions that seamlessly integrate a client’s financial interactions with Payments.

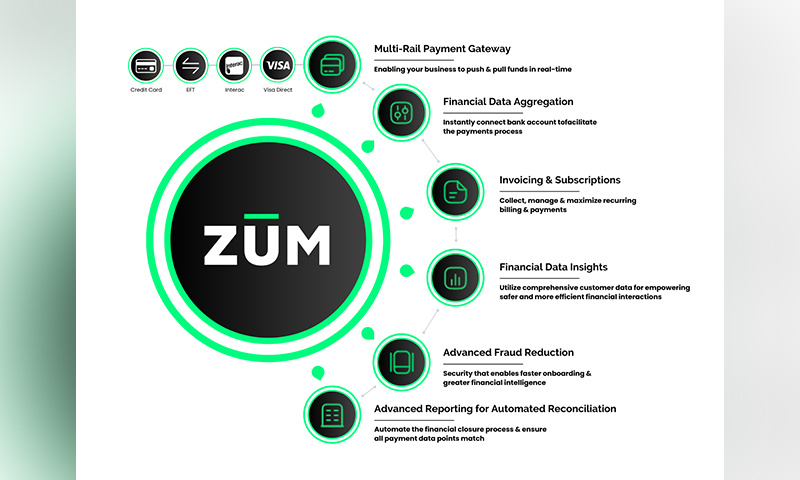

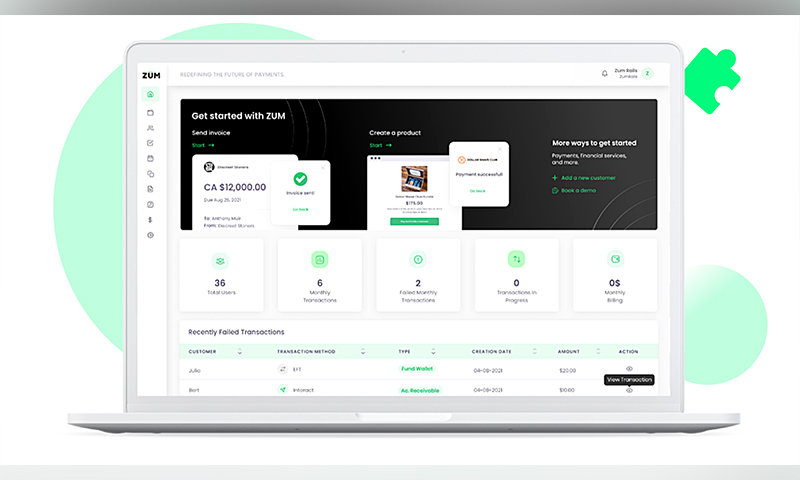

Exploring the convergence of open banking and instant payments, Zūm Rails introduces Canada’s only instant Payment gateway. Marc emphasizes, “Merging open banking and instant payments, Zūm Rails’ all-in-one payments gateway allows users to seamlessly utilize the payment rails that best fit their needs in the fastest, safest and most efficient way possible.” This innovative platform supports the entire payment journey, from customer onboarding to advanced data aggregation and KYC tools. Operating in real-time, it places a strong emphasis on fraud prevention and account validation and simplifies the reconciliation process—all from a single API.

“We have created software that has the functionality and capabilities to replace an entire payments tech stack with just one user-friendly interface,” Marc explains. In contrast to disparate digital tools, Zūm Rails offers a centralized hub empowering businesses to move, manage, and analyze their funds seamlessly, reducing risks and elevating their customers’ payment experience.

Transforming Transactions, Empowering Users and Businesses

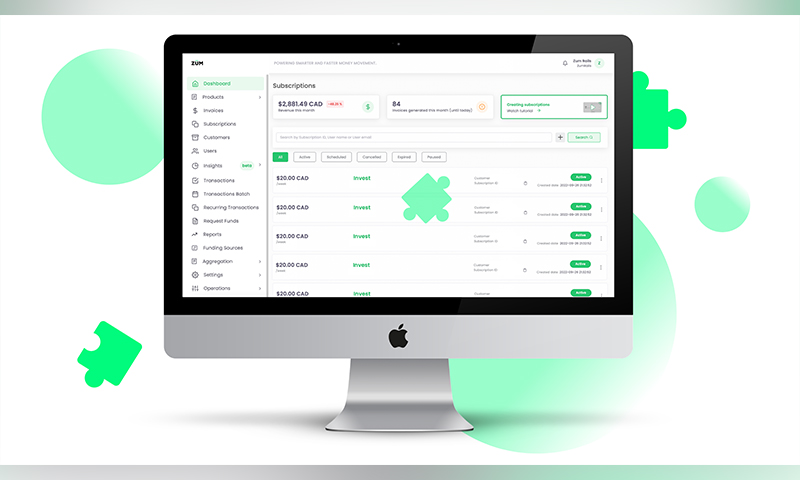

Zūm Rails undergoes a profound metamorphosis, turning individual transactions into seamless financial interactions. The transformative journey begins with onboarding, where Zūm Rails doesn’t just streamline but elevates the customer experience. Marc expresses the significance, stating, “From the initial onboarding, we aim to create an experience where users can seamlessly connect their accounts through aggregation. It’s about ease, about logging in using their banking credentials and connecting instantly.”

Once the connection is established, users experience unparalleled freedom over their funds, navigating Zūm Rails’ open banking gateway with the swiftness of a keystroke. Behind this user-friendly façade, Marc assures, “Our software is hard at work validating accounts through name-verification, running penny tests, and eliminating the risk of fraud. It’s about making the entire process easier, faster, and safer for our users.”

Yet, Zūm Rails is not just a user-centric platform; it’s a powerful tool for businesses. Marc highlights this, stating, “Businesses gain access to essential insights and reporting, allowing them to better understand and support their customers. It’s about providing businesses with the tools they need to operate efficiently and intelligently.”

Zūm Rails, therefore, redefines the essence of moving money—making it easier, faster, safer, and smarter. Marc emphasizes, “By enabling users to connect their bank accounts via data aggregation, we’ve turned a historically time-consuming process into a matter of seconds. It’s about empowering businesses to make informed decisions swiftly and granting customers access to funds with unprecedented speed.”

Redefining Payments with Omni-Rail Innovation and Advanced Security Features

Zūm Rails stands out as a premier payment gateway, pioneering the fusion of Data Aggregation and KYC elements at the point of sign-up. Marc Milewski, Co-Founder and CEO, emphasizes, “Our approach is unique—we not only derisk instant payments but also capture and store multiple payment rail information in a single solution. Being an Omni-rail provider means our customers can make safer and smarter choices for payment options based on their individual needs.”

Here are some key features that define Zūm Rails’ software, especially concerning KYC/AML tools and real-time fund movement:

Multi-rail payment provider: Users can choose the payment rails that best fit their individual needs and use cases but still maintain the convenience of one centralized wallet, allowing better financial visibility and tracking.

Financial data aggregation: Businesses can enable their customers to seamlessly connect their bank accounts using any digital device, leading to faster onboarding and a more streamlined payment experience.

Partner portal: Through our open API, third parties and business partners can offer Zūm Rails a full payment solution line-up but in a completely white-labeled experience.

KYC data and financial insights: Businesses can have greater visibility into their customer’s financial trends and habits in the form of practical reports and analytics, allowing for more informed decision-making and enabling businesses to offer a more customized experience.

Fraud monitoring and prevention tools: Protecting our user’s digital assets is our top priority, so we have implemented a multifaceted system to ensure both financial security and data privacy, including name-match verification, penny testing as well as PCI DSS compliance, and SOC II Type II compliance.

Invoicing and subscriptions: Users can set up automated invoicing and recurring payments to eliminate redundant tasks and reduce the risk of account delinquency.

Zūm Rails’ commitment extends beyond facilitating transactions; it’s about providing a comprehensive, secure, and customizable payment experience for both users and businesses.

Securing Transactions, Streamlining Fund Transfers, and Revolutionizing Payment Processes

Marc Milewski sheds light on Zūm Rails’ Visa Direct solution, stating, “We are the only market solution that can validate the name on a Visa debit card, ensuring no stolen cards can be used for instant payments. Stolen cards contribute significantly to fraud, and there are almost no tools to prevent it. Zūm Rails figured it out before everyone else.” This unique validation mechanism positions Zūm Rails as a pioneer in thwarting fraudulent activities associated with stolen cards, ensuring the security of every Visa Direct transaction.

Addressing the Interac service, Marc explains, “Zūm Rails has worked tirelessly to deliver multiple Interac products using multiple banks in the background. This is because multiple banks don’t really have a complete solution. We aim to shield our clients from complexities such as navigating bank-specific protocols and potential fumbles. Our Interac solution not only facilitates real-time fund transfers but also layers in Aggregation to manage risk and prevent stolen cards.”

One standout advantage is the seamless integration with other rails; as Marc points out, “Our API allows users to have access to other rails with one line of code change, making setup and processing easier than any other solution on the market.”

Speaking about the EFT service, Marc emphasizes, “Zūm Rails boasts one of the most robust and comprehensive EFT solutions in Canada. We integrate data aggregation and enhanced transactional risk monitoring to keep this delicate network as secure as possible. Our efforts also focus on simplifying complexities for end customers, with webhooks providing all potential outcomes via our API, allowing clients to automate their next actions based on specific successes or failures.”

Marc outlines Zūm Rails’ approach to credit card processing, stating, “We work with multiple banks and even operate as a Payfac ourselves. A distinctive feature is our ability to split credit card payments and payout directly from the merchant account. This ensures marketplaces and large-scale retailers can automate quicker payouts, particularly in scenarios like ticketing sites, gig economy platforms, or any marketplace aggregating multiple users/stores.”

Innovating Beyond Weak Points: Shaping the Industry Standard

Marc emphasizes Zūm Rails’ commitment to addressing pain points within users’ payment journeys, stating, “Identifying and eliminating these weak points not only drives our software improvements but also sets a new industry standard for how money is moved. We see each challenge as an opportunity to innovate, constantly aiming to beat yesterday’s best.”

Leveraging pre-existing tools, Zūm Rails meticulously analyzes transaction speeds, customer spending habits, and the dynamic interactions between customers and businesses in their financial realm. Marc underscores, “Applying this data is our way of improving the overall financial experience. We focus on utilizing emerging technologies to enhance our software rather than comparing ourselves to competitors running a different race. We set the trend; companies follow our lead.”

Zūm Rails goes the extra mile to ensure users are primed for success from their first transaction onward. Marc Milewski highlights this personalized approach, stating, “We assign a specialized integrations specialist to assess our users’ unique needs and tailor their integration to specific use cases. A custom API is crafted with the user’s entire payments workflow in mind, ensuring a streamlined and user-friendly experience.”

To further empower users, Zūm Rails provides an extensive library of resources. Marc explains, “We offer a wealth of how-to videos, articles, and other resources to answer questions along the way. Our goal is to equip users with the knowledge they need to navigate seamlessly through our platform.”

Recognizing that growth is an ongoing journey, Zūm Rails stands by its users with a knowledgeable post-live support team. Marc asserts, “As our users grow their business, our support team provides ongoing guidance and assistance. We are dedicated to being there every step of the way, ensuring our users’ success aligns with their aspirations.”

Pioneering a Comprehensive Payment Platform

In a strategic alliance with FISERV, Zūm Rails has taken a monumental step in developing a revolutionary payment platform. Marc Milewski affirms, “This collaboration allows us to seamlessly combine different services into a cohesive solution for our clientele. We’ve obtained authorization as a comprehensive payment facilitator, integrating conventional card acceptance, real-time payment processing, and distribution services.” By intertwining these features with bank data aggregation services, Zūm Rails aims to offer an all-encompassing solution for both traditional and contemporary payment acceptance techniques, robust capabilities in KYC, and credit scoring. This positions us as a versatile resource, catering to a broad spectrum of customer requirements.

Having successfully expanded into the US market, Zūm Rails is poised for international outreach, driven by user demand. Operating in the dynamic digital space, Marc emphasizes, “Our software is ever-evolving to address industry gaps and solve the everyday problems in payments that businesses and their customers face. We are committed to staying at the forefront of payment technology.”

A Vision Beyond Transactions

Zūm Rails sees payments not merely as the movement of funds from A to B but as a “financial interaction.” Marc underscores, “This perspective starts from how you onboard clients and how you handle KYC. Recognizing that payments entail an element of risk, we aim to own more than just the movement of funds. Many companies have commoditized this industry, but we want to go beyond it. We want to own the KYC and risk around it, making payments safer and harder for others to displace us.”

The commitment to ownership and continuous building is ingrained in Zūm Rails’ culture. Marc notes, “We don’t mind getting calluses on our hands from the building. It’s part of our culture to always be building, not just to move funds but to own more.”

Marc reveals exciting future plans, stating, “We’re gearing up to offer virtual cards for instant funding and a unique way to monetize accounts payables for our clients. Additionally, new countries and KYC products are on the horizon, showcasing our commitment to innovation and staying ahead in the payment landscape.”

For More Info: https://zumrails.com/